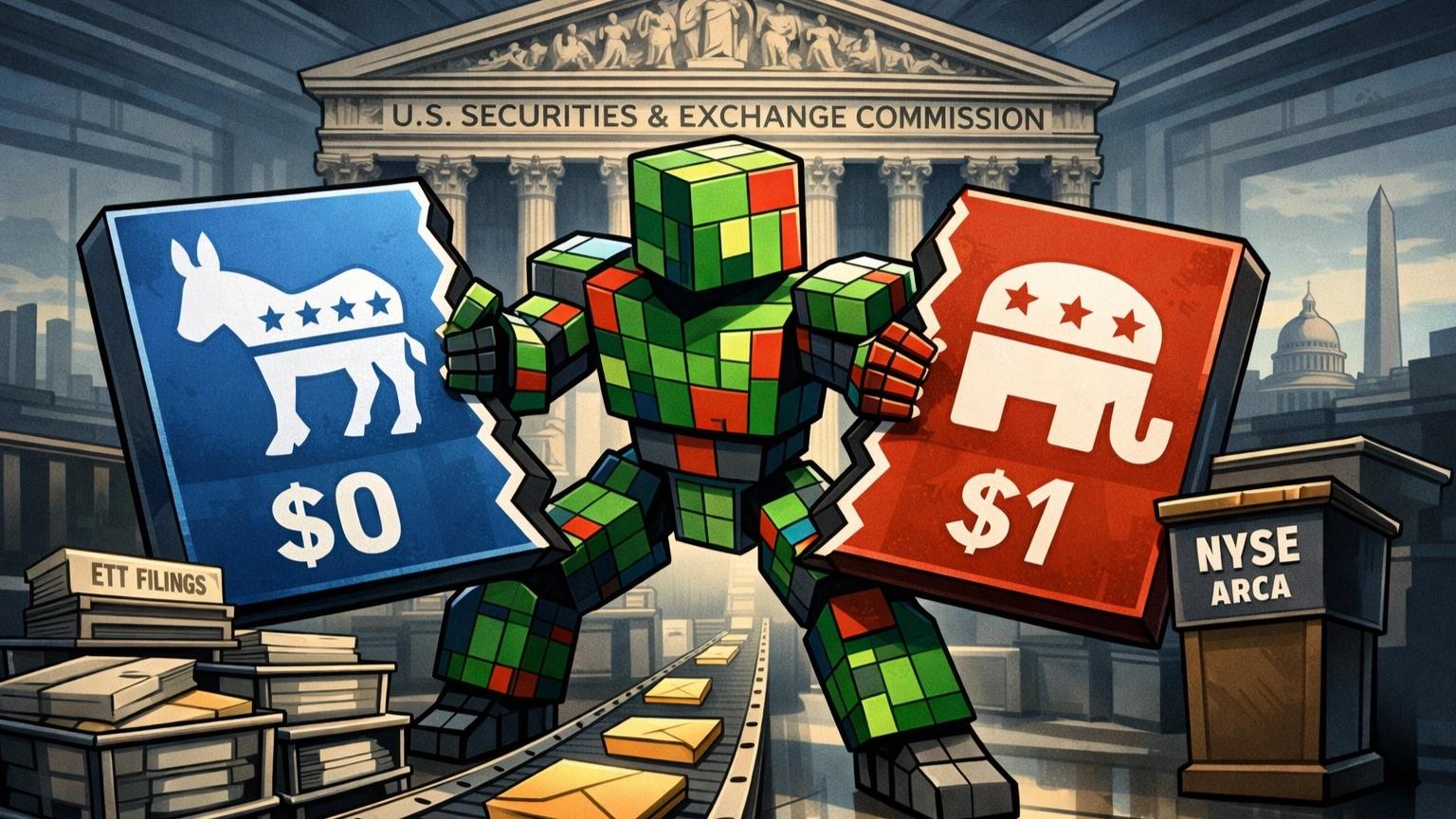

Bitwise, GraniteShares and Roundhill File Six Election Prediction ETFs Each as Monthly Market Volume Hits $15.4 Billion

Wall Street Asset Managers Target 2026 Midterms and 2028 Presidential Race With Binary Outcome Funds Structured to Settle at $0 or $1

TL;DR

- Bitwise, GraniteShares and Roundhill filed six election outcome ETFs each on February 14–17, 2026, tied to the 2026 and 2028 U.S. elections.

- Funds will invest at least 80% in binary event contracts that settle at $1 or $0, with risk of losing substantially all value.

- Prediction markets logged $15.4 billion in January 2026 volume, 122 million transactions and 830,520 monthly users.

We’ve launched the all-new COIN360 Perp DEX, built for traders who move fast!

Trade 130+ assets with up to 100× leverage, enjoy instant order placement and low-slippage swaps, and earn USDC passive yield while climbing the leaderboard. Your trades deserve more than speed — they deserve mastery.

Bitwise Asset Management and GraniteShares submitted filings with the U.S. Securities and Exchange Commission on February 17, 2026, seeking approval to launch six exchange-traded funds each tied to specific U.S. election outcomes, following a similar move by Roundhill Investments on February 14, 2026. The proposed products target the 2026 midterm elections and the 2028 presidential race, marking one of the most direct attempts by traditional asset managers to package prediction market exposure into regulated ETF structures.

Bitwise’s submission, filed as a post-effective amendment, outlines a new product suite branded as “PredictionShares,” designed for listing and primary trading on NYSE Arca. The lineup includes funds tracking whether a Democratic or Republican candidate wins the presidency in 2028, alongside separate vehicles tied to which party controls the Senate and House following the 2026 elections. GraniteShares filed for a parallel six-fund structure covering the same election scenarios.

Roundhill’s earlier filing details a comparable framework centered on binary event contracts that pay out a fixed amount depending on the outcome of a defined political event. Across the filings, each ETF is structured to invest at least 80% of its net assets in derivatives or swap exposures linked to the specified election result. Shares are designed to reflect market-implied probabilities and fluctuate between $0 and $1 based on evolving expectations tied to polling, news flow and sentiment.

Risk disclosures included in the registration statements describe the binary nature of the contracts. Bitwise’s prospectus states that if the referenced outcome does not occur, the fund “will lose substantially all of its value.” Similar language appears in other filings, noting that only the ETF tied to the correct outcome would realize capital appreciation, while competing outcome funds could decline toward zero at settlement.

Bloomberg ETF analyst James Seyffart commented on the expanding range of ETF concepts, writing that “the financialization and ETF-ization of everything continues,” and adding that it is extremely unlikely these filings will be the last. Matt Hougan, Chief Investment Officer at Bitwise, said that prediction markets are expanding in scale and relevance and that client demand influenced the firm’s decision to pursue the strategy.

Data compiled by Dune Analytics show prediction market trading activity reached a record $15.4 billion in January 2026. Transaction counts during that month exceeded 122 million, while monthly user participation climbed to 830,520. The increase in volume and participation coincides with rising institutional attention toward event-based contracts tied to U.S. political outcomes.

Regulatory oversight remains a central factor in the structure of the proposed funds. Filings note that U.S. rules governing event contracts are evolving, with the Commodity Futures Trading Commission maintaining authority over certain prediction market products. Prospectuses caution that future regulatory changes could affect the operation or legality of such funds and advise investors to review risk factors carefully.

The ETF shares are intended to trade on secondary markets like other exchange-traded products, allowing investors to gain exposure to election outcome probabilities through brokerage accounts rather than participating directly in online prediction platforms. Each fund’s net asset value would track the underlying event contract pricing, settling at either $1 or $0 upon resolution of the referenced election event.

This article has been refined and enhanced by ChatGPT.